The Impact of Currency Risks on Loans for International Auctions

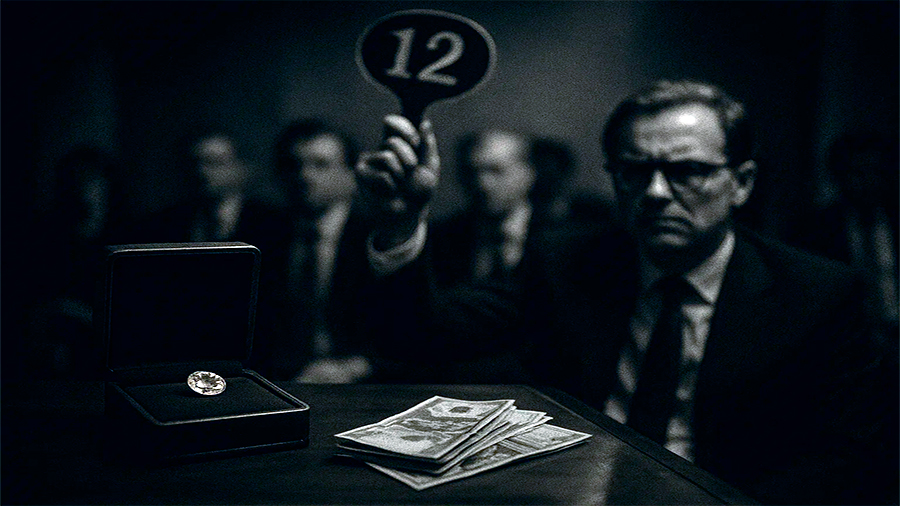

International auctions attract buyers from every corner of the globe. Whether bidding on rare art, collectible jewellery, or precious stones, participants often use loans to finance purchases. Yet borrowing across borders carries an extra layer of complexity: currency risk. A loan taken in one currency can become far more expensive if exchange rates shift before repayment. What starts as a calculated investment can quickly erode profits or even create losses. Understanding how currency fluctuations affect loans is essential for anyone stepping into the global auction market.

Why Currency Fluctuations Matter

When buyers borrow in a currency different from the one they earn or plan to repay in, they expose themselves to exchange rate volatility. A loan in U.S. dollars might look stable at the start, but if the dollar strengthens against the euro or yen, repayment costs increase. The reverse is also possible: a weakening loan currency can reduce costs, though relying on such luck is risky. Currency swings can add thousands or even millions to the final price of an auction purchase. For investors chasing long-term gains, unplanned currency movements can undermine years of strategy. This is why lenders and financial advisers stress currency planning as much as interest rates when evaluating auction loans.

| Loan Currency | Repayment Currency | Potential Risk |

|---|---|---|

| USD | EUR | Stronger dollar raises repayment cost |

| GBP | USD | Weaker pound increases effective debt |

| JPY | USD | Sudden shifts can amplify repayment burdens |

How Auctions Intensify Risk

Auctions create unique financial pressure. Winning bids require quick settlement, often within days. This means loans are structured with strict timelines. If repayment coincides with unfavorable currency shifts, buyers face higher-than-expected costs immediately. Auctions also involve international movement of assets. Import duties, taxes, and fees are frequently denominated in local currencies, creating additional layers of exposure. For example, a gemstone purchased in Hong Kong with a dollar loan may later face euro-based resale costs in Europe. Each transaction step multiplies the impact of currency volatility, turning what looked like a simple loan into a web of financial risks.

| Stage | Currency Exposure | Risk Impact |

|---|---|---|

| Bidding/Loan | Borrower’s loan currency | Initial financing cost |

| Settlement | Auction house currency | Immediate repayment mismatch |

| Resale | Market resale currency | Final profit or loss |

Tools to Protect Against Losses

Currency risk can be managed, but it requires planning. Hedging instruments such as forward contracts allow borrowers to lock in exchange rates ahead of time. Options provide flexibility by offering the right, but not the obligation, to convert at a favorable rate. Some lenders integrate currency protection directly into loan products, charging slightly higher fees in exchange for stability. Another approach is to borrow in the same currency as the auction or resale market, reducing exposure but limiting flexibility. While none of these solutions remove risk entirely, they reduce uncertainty, making loan planning more predictable.

Practical strategies buyers use

- Taking loans in the auction’s settlement currency to minimize mismatch.

- Using forward contracts to fix repayment costs in advance.

- Balancing exposure by holding reserves in multiple currencies.

- Negotiating loan terms that include built-in exchange rate buffers.

Examples From the Market

Consider a collector borrowing in euros to finance a diamond purchase priced in U.S. dollars. If the dollar strengthens by ten percent before repayment, the effective debt rises by the same margin, reducing potential profit. Dealers who regularly operate in Asia often borrow in Hong Kong dollars to match auction settlements, reducing volatility. Others diversify by splitting financing across currencies, ensuring no single exchange rate shift can derail repayment. On the other hand, some borrowers ignore hedging altogether, assuming markets will remain stable, only to face sudden jumps that wipe out their margins. These scenarios repeat frequently, showing that currency planning is as critical as auction strategy itself.

Digital Currencies and AI Hedging

The future of managing currency risk in auction loans may be shaped by technology. Central bank digital currencies (CBDCs) could allow direct settlement in multiple currencies with minimal conversion costs, reducing exposure to volatility. Blockchain-based smart contracts may link loans and settlements in real time, automatically adjusting repayments to exchange rate movements. Fintech lenders are already experimenting with AI-driven hedging tools that predict shifts in major currency pairs and adjust coverage instantly. Tokenized assets may also create new financing models, where buyers borrow directly in digital currencies pegged to global markets. While these innovations promise greater flexibility, they also introduce new vulnerabilities. Cybersecurity risks, regulatory gaps, and dependence on algorithms may create fresh challenges. For disciplined borrowers, however, digital solutions may soon make managing currency risk more precise and transparent than ever before.

Worst-case digital scenarios

Technology does not remove risk entirely. Imagine a smart contract linked to a CBDC loan miscalculating an exchange rate feed due to a system error. The borrower could find repayment locked at a much higher cost, with little human oversight to correct it quickly. In another scenario, an AI hedging tool might fail during a sudden currency shock, leaving exposure uncovered at the worst moment. Tokenized lending pools may also collapse if volatility drives investors away, forcing early repayment demands. These possibilities show that while digital tools add speed and convenience, borrowers still need backup strategies to avoid being caught in unexpected failures.

Preventive measures for the digital era

- Maintain manual backup contracts or parallel agreements outside automated systems.

- Diversify loans across traditional and digital products to reduce reliance on a single platform.

- Regularly monitor AI-based hedging tools instead of trusting them to operate unchecked.

- Work with lenders that provide human oversight alongside automated smart contracts.

- Keep a reserve fund in stable currencies to cover sudden repayment mismatches.

Conclusion

Loans are powerful tools for participating in international auctions, but currency risks can make or break their value. Exchange rate shifts affect every stage of borrowing—from repayment schedules to resale margins—introducing unpredictability into already competitive markets. Hedging instruments, currency-matched loans, and diversified financing are practical ways to stay protected. Looking ahead, CBDCs, blockchain smart contracts, and AI hedging may transform how buyers defend against volatility. But worst-case scenarios remind us that digital systems are not infallible. Those who prepare for both traditional and digital risks, and who keep preventive measures in place, will be best positioned to turn loans into opportunities rather than burdens.