The Impact of Lending Rates on Demand for Luxury Stones

Luxury stones—rare diamonds, sapphires, emeralds, and rubies—sit at the intersection of beauty and finance. Their value is not shaped only by rarity and craftsmanship but also by access to credit. When lending rates rise or fall, the appetite for high-value jewellery lots shifts dramatically. Collectors, dealers, and investors all weigh the cost of borrowing against potential appreciation. Understanding how lending rates affect demand helps explain why auctions sometimes surge with energy and at other times feel subdued. The ability to predict these shifts gives buyers and sellers an advantage in navigating markets where emotion and economics intertwine.

Why Interest Rates Influence Stone Markets

Financing plays a central role in auctions and private sales of jewellery. Few participants pay entirely in cash, especially for lots valued in the millions. Loans bridge the gap, but their cost depends on lending rates. When rates are low, borrowing is cheap, encouraging buyers to compete aggressively. This inflates demand and can push prices above initial estimates. Conversely, when rates climb, financing becomes expensive, discouraging risk-taking and slowing bidding activity. The sensitivity of buyers to credit costs explains why lending conditions ripple across luxury stone markets. Auctions are not just about desire; they are about financial feasibility shaped by interest rates. Investors watch central bank announcements as closely as catalogue previews, knowing borrowing costs may decide whether they can participate confidently or cautiously.

| Interest Rate Environment | Buyer Behavior | Market Impact |

|---|---|---|

| Low rates | More borrowing, aggressive bidding | Higher prices, strong demand |

| Moderate rates | Selective borrowing, cautious bids | Stable pricing, moderate demand |

| High rates | Reduced borrowing, limited participation | Lower prices, weaker demand |

How Auctions Respond to Changing Rates

Auctions are especially sensitive to lending costs because settlement deadlines are strict. When rates are favorable, bidders draw on credit lines with confidence, knowing repayment will not eat into potential profits. Stones with unique provenance or exceptional quality often see bidding wars under these conditions. Rising rates, however, cool enthusiasm. Participants hesitate to stretch budgets, and average-quality lots may receive fewer bids. This creates uneven results: extraordinary pieces still sell, but mid-range jewellery stagnates. The overall rhythm of an auction often mirrors central bank decisions, showing how macroeconomic shifts filter down to the sale of gemstones. In this way, global monetary policy indirectly shapes the energy inside a single auction hall.

| Stone Category | Effect of Low Rates | Effect of High Rates |

|---|---|---|

| Rare diamonds | Strong competition, record prices | Selective bidding, fewer transactions |

| Colored gemstones | Increased demand, broader interest | Market narrows to top buyers only |

| Signed jewellery | Rising values due to collector access | More unsold lots, cautious collectors |

Examples From Recent Trends

When global lending rates dropped following economic slowdowns, jewellery auctions saw an influx of buyers using credit lines to secure rare pieces. Blue diamonds and vintage signed jewellery hit record prices, supported by cheap financing. Dealers expanded inventories aggressively, relying on low-cost borrowing to hold stones for future resale. The opposite occurred during tightening cycles, when higher rates discouraged speculative buying. Collectors focused on only the most exceptional pieces, while more common lots remained unsold or sold below estimates. These shifts highlight the close relationship between interest rates and the perceived value of luxury stones in competitive markets. Market cycles prove that stones are not insulated from finance—they are deeply tied to broader credit conditions.

Strategies Buyers Use in Different Environments

Buyers adapt quickly to changing lending costs. In low-rate environments, many use credit freely, assuming they can repay once resale or appreciation occurs. In high-rate environments, buyers shift to cash purchases or limit borrowing to extraordinary lots. Some hedge against rate changes by securing fixed-rate loans before auctions, while others diversify financing sources to balance risks. Dealers managing large inventories may pledge assets instead of borrowing at higher rates, trading flexibility for lower costs. Collectors often time their purchases to coincide with favorable credit cycles, delaying acquisitions until financing conditions stabilize. The common thread is flexibility: successful participants adjust their borrowing strategies to protect margins while still competing for key pieces. Understanding how to adapt financing to interest rate cycles has become as important as evaluating the stones themselves.

| Rate Level | Buyer Strategy |

|---|---|

| Low | Borrow aggressively, expand collections |

| Rising | Secure fixed-rate financing, reduce exposure |

| High | Rely on cash or pledge assets, focus on rarest lots |

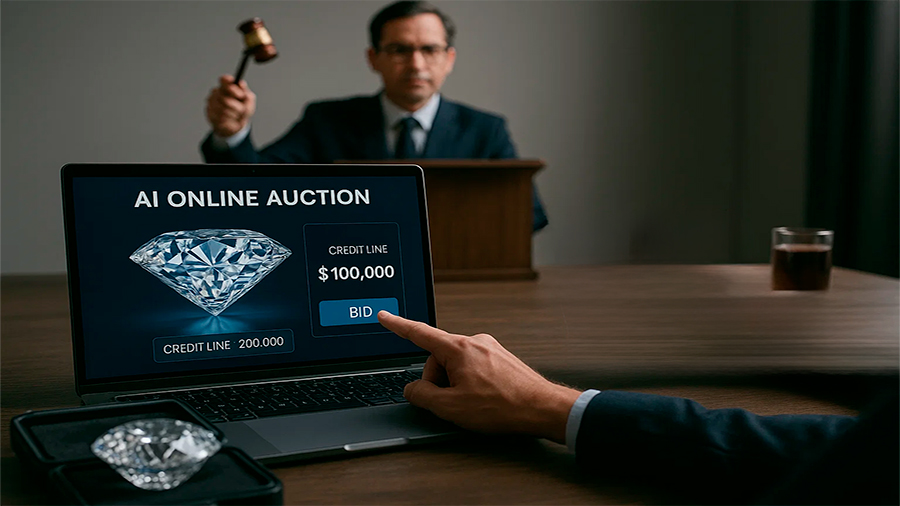

Digital Lending and AI-Driven Auctions

The future of luxury stone financing may look very different. As auctions shift further into digital platforms, fintech lenders are embedding credit lines directly into bidding systems. This allows buyers to borrow instantly during live auctions, with AI analyzing creditworthiness in real time. Such speed could increase demand during low-rate cycles, magnifying price surges for rare stones. Blockchain-based smart contracts may also reduce risk by tying loans directly to assets, ensuring ownership remains conditional until repayment. At the same time, tokenized financing models could allow groups of investors to share the cost of a stone, spreading risk and making borrowing more accessible. Yet these innovations bring challenges: reliance on automated systems can magnify errors, and regulation lags behind technological adoption. The profitability of auctions in the 2030s may depend as much on digital lending infrastructure as on the rarity of stones themselves.

Shaping demand in the next decade

If digital lending tools make credit more accessible, demand for mid-tier stones may rise, broadening participation beyond elite buyers. However, if global interest rates remain volatile, reliance on fast digital credit could increase risks of overbidding and debt stress. Balancing innovation with caution will determine whether the next generation of jewellery buyers thrives or falters.

Conclusion

Lending rates shape more than just the cost of credit—they shape the very rhythm of demand in luxury stone markets. Low rates fuel competition and record-setting sales, while high rates create caution, narrowing participation and lowering average prices. Buyers and dealers alike succeed when they adjust strategies, aligning borrowing with prevailing financial conditions. Looking ahead, digital credit, AI-driven risk analysis, and tokenized financing will add both opportunity and complexity. In a market where finance meets luxury, understanding lending rates is no longer optional—it is essential for anyone hoping to navigate auctions successfully and secure jewels that hold both beauty and long-term value.